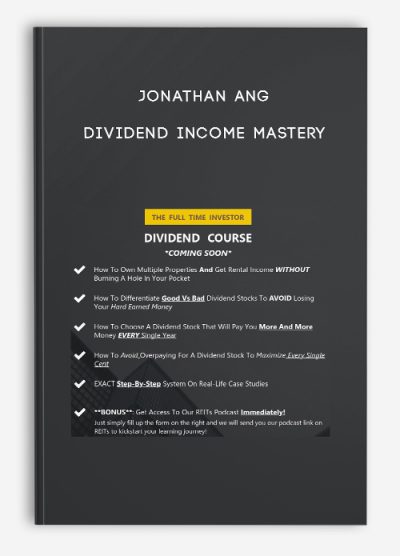

Dividend Income Mastery by Jonathan Ang

Original price was: $197.00.$47.00Current price is: $47.00.

- Description

Description

Dividend Income Mastery by Jonathan Ang

**More information:

Get Dividend Income Mastery by Jonathan Ang at bestoftrader.com

Description

WHAT’S INCLUDED IN THE COURSE?

25+ Value Packed Video Tutorials

In this in-depth course, we walk you through our step-by-step blueprint of how we

filter, select and analyze REITs.

You’ll also be learning:

✓ How to Generate Passive Income by Investing in Singapore REITs

✓ How to Become A Multiple Property Owner And Get Rental Income With

Little Capital, ZERO Paperwork, Headaches and Mortgages

✓ How to Assess a Company’s Debts to Avoid Bad Businesses

✓ How To Choose A Company That Will Pay You More And More Money EVERY Single Year

✓H ow To Avoid Overpaying For Companies And Spot Great Bargains

✓ A Step-By-Step Guidance On Filtering, Selecting and Valuing The Companies

✓ How to Reach Your Passive Income Goals

BONUS: 10-Step REITs Checklist

Get a step-by-step checklist to aid you in your next purchase of REITs!

Immediate Lifetime Access

Instant access to ALL the content FOR LIFE! – No upsells or anything like that…

We like our content to be value-packed!

Your Instructor

Authors Of Value Investing: Expand Your Circle Of Competence

Amazon Best-Seller 2019

Jonathan Ang is a full-time investor, international speaker and an investment coach. He started his investment journey at the age of 18, and he is passionate in helping new investors to kick start their investment journey.

He is well-versed in the Singapore markets, especially the REITs sector. Over the past 2 years, he has successfully trained over hundreds of students in investing.

Course Curriculum

-

Start

WATCH THIS FIRST! (1:48)

-

Start

THE MOST IMPORTANT STEP!!

-

Start

Watch DIM On Your Phone!

-

Start

1.1 Introduction to REITs (1:45)

-

Start

1.2 Advantages of REITs (7:26)

-

Start

1.3 Structure of REITs (9:32)

-

Start

1.4 Property Portfolio (3:33)

-

Start

1.5 Market Capitalization (3:40)

-

Start

2.1 Debt Gearing Ratio (4:48)

-

Start

2.2 Debt Gearing Ratio (CASE STUDY) (4:20)

-

Start

2.3 Debt Maturity Profile (8:19)

-

Start

2.4 Debt Maturity (CASE STUDY) (6:49)

-

Start

2.5 Cost Of Borrowing (5:07)

-

Start

2.6 Cost Of Borrowing (CASE STUDY) (10:54)

-

Start

2.7 Interest Coverage (3:49)

-

Start

2.8 Interest Coverage (CASE STUDY) (2:31)