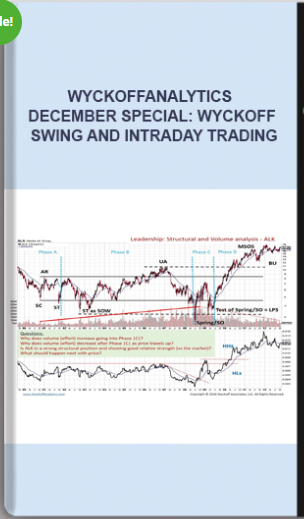

Wyckoffanalytics – December Special: Wyckoff Swing and Intraday Trading

Original price was: $495.00.$57.00Current price is: $57.00.

Sale Page :Wyckoffanalytics

- Description

Description

Wyckoffanalytics – December Special: Wyckoff Swing and Intraday Trading

Checkout more:Wyckoffanalytics

Sale Page : Wyckoffanalytics

This product is available

You can refer to the screenshots here :

Please contact us to get free sample

On December 6th and 13th, Golden Gate University Adjunct Professor Roman Bogomazov will be presenting a two-part online workshop:

Improving Your Wyckoff Swing Trading Results with Intraday Techniques.

The Wyckoff Method works especially well for swing trading, particularly in conjunction with market turns. For his personal account, Roman uses swing trading almost exclusively; he has spent many hundreds of hours researching, analyzing and testing (with his own money!) the materials covered in these sessions. This workshop is designed for intermediate to advanced traders and will focus primarily on trades lasting from a few days to several months.

During these webinars you will learn how to:

-

Identify the best structural swing trade candidates in the context of a trending environment

-

Select the highest-probability swing trade candidates that should out-perform the market by examining:

-

Causality

-

The likely character of the next move

-

The timing of the trade

-

-

Utilize intraday data to enhance the profitability of your swing trading by:

-

Observing intraday price and volume behavior to identify early reversal points

-

Studying intraday moves to identify the character of the next swing trend

-

Using intraday entry points and scaling in add-ons to build a swing position

-

Looking for a change of intraday behavior around swing trade exits as early indications of trend reversal and for swing reversal confirmation of these intraday early alerts

-

-

Define resistance and support in terms of vertical and horizontal volume signatures as well as price, as well as how to anticipate and navigate these critical chart landscapes using intraday data

-

Use significant bars in combination with volume as a basis for informed decision-making regarding swing-trade entries and exits.

All of these concepts will be demonstrated with illustrative case studies of U.S stocks and futures.

All sessions will be recorded and posted on a password-protected page for participants to access and review for one full year. Participants will receive a pdf file of the slides used in the presentations.

Roman’s prior swing and intraday trading workshops generated enthusiastic feedback from participants:

“Great webinar, well worth the time and money. I’m most impressed by the completeness of the program, from finding stocks to VERY DETAILED POINTS OF ENTRY methods…to ways to ensure you stay in the move while showing the best time to get out. That’s what I’ve been looking for. This course checked all the boxes on my stock trading wishlist.”

“Application of the information covered in this course by Roman will make you money!”

“Roman does a great job. Never found anyone better at deconstructing this methodology.”

Get Wyckoffanalytics – December Special: Wyckoff Swing and Intraday Trading on bestoftrader.com

Wyckoffanalytics, December Special: Wyckoff Swing and Intraday Trading, Download December Special: Wyckoff Swing and Intraday Trading, Free December Special: Wyckoff Swing and Intraday Trading, December Special: Wyckoff Swing and Intraday Trading Torrent, December Special: Wyckoff Swing and Intraday Trading Review, December Special: Wyckoff Swing and Intraday Trading Groupbuy.