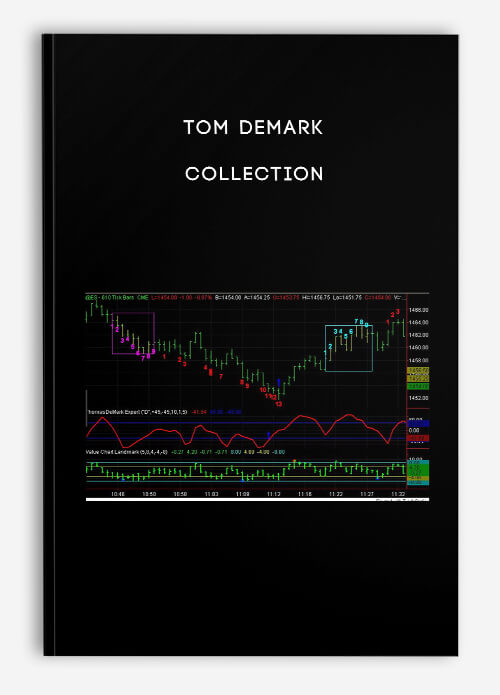

Tom Demark Collection

$75.00

Product Include:

File size:

- Description

Description

Tom Demark Collection

**More information:

Get Tom Demark Collection at bestoftrader.com

Description

Praise for DeMark Indicators by Jason Perl

“Tom DeMark, the man whose work inspired this book, is a unique, interesting, and ofttimes iconoclastic technical analyst. Simply put, he thinks about the markets differently from the way you or I do. So why should you read this book? Because, having read it, you will almost certainly think about the markets and technical analysis differently.”

—John Bollinger, CFA, CMT, www.BollingerBands.com

“Jason Perl has taken the playbook from the market’s John Wooden, Tom DeMark, and translated it engagingly in a format that traders of all levels will appreciate. As one who has used these indicators for more than twenty years, I too am appreciative of Jason’s clarity.”

—Peter Borish, Chairman and CEO, Computer Trading Corporation

“Jason Perl has created a trading primer that will help both the professional and the layman interpret the DeMark indicators, which I believe represent the most robust and powerful methods to track securities and establish timely investment positions. Think of DeMark Indicators as the Rosetta stone of market-timing technology.” —John Burbank, Founder and CIO, Passport Capital “Having observed his market calls real time over the years, I can say that Jason Perl’s application of the DeMark indicators distinguishes his work from industry peers when it comes to market timing. This book demonstrates how traders can benefit from his insight, using the studies to identify the exhaustion of established trends or the onset of new ones.Whether you’re fundamentally or technically inclined, Perl’s DeMark Indicators is an invaluable trading resource.”

—Leon G. Cooperman, Chairman, Omega Advisors

“Jason Perl is the trader’s technician. DeMark indicators are a difficult subject matter, but Jason shows simply how the theory can be applied practically to markets. Whether you’re day-trading or taking medium-term positions, using the applications can only be of increased value.”

—David Kyte, Founder, Kyte Group Limited

Trading Course

So what is trading?

Trade involves the transfer of goods or services from one person or entity to another, often in exchange for money.

Economists refer to a system or network that allows trade as a market.

An early form of trade, barter, saw the direct exchange of goods and services for other goods and services.

Barter involves trading things without the use of money. When either bartering party started to involve precious metals,

these gained symbolic as well as practical importance.[citation needed] Modern traders generally negotiate through a medium of exchange,

such as money. As a result, buying can be separated from selling, or earning. The invention of money (and later of credit,

paper money and non-physical money) greatly simplified and promoted trade.

Trade between two traders is called bilateral trade, while trade involving more than two traders is called multilateral trade.