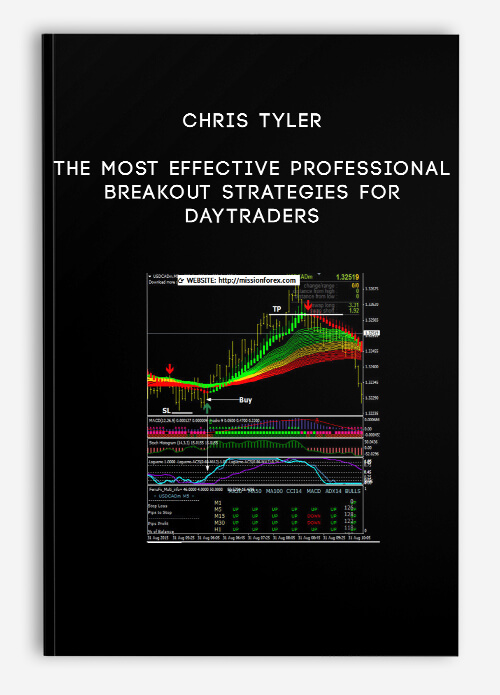

Chris Tyler – The Most Effective Professional Breakout Strategies For Daytraders

$35.00

Product Include:

File size:

- Description

Description

Chris Tyler – The Most Effective Professional Breakout Strategies For Daytraders

**More information:

Get Chris Tyler – The Most Effective Professional Breakout Strategies For Daytraders at bestoftrader.com

Description

WOULD YOU LIKE TO LEARN 7 OF THE BEST BREAKOUT STRATEGIES USED BY SUCCESSFUL PROFESSIONAL DAYTRADERS?

Now You Can! Let 8-Year Floor Trading Veteran Chris Tyler Teach You These Strategies And Much, Much More!

Christopher A. Tyler was an Equity Options Market Maker for 8 years on the American & Pacific Exchanges and then broadened his career by becoming an equities trader. He writes the Nightly Daytraders Report, as well as the Nightly Options Report, and provides daily stock and options analysis from the TradingMarkets War Room.

To find the stocks that move the fastest in one direction for the longest possible duration–

there is no better strategy than…Intraday Breakouts!

Now for the very first time, the very best professional breakout strategies for daytraders have been brought together into one teaching medium.

You will learn these in-depth methods in Chris’ new training module: “The 7 Most Effective Professional Breakout Strategies For Daytraders.” In it, Chris will teach and train you to apply these breakout strategies so that you can enter the most powerful intraday breakouts.

Who Is This Breakout Training Module Designed For?

If you are a serious and dedicated daytrader who wants to learn and properly daytrade some of the best intraday breakout strategies, this module is for you.

Chris Tyler will first teach you all of the basic knowledge that every daytrader must know in order to trade breakouts successfully.

Once you have this solid foundation, Chris Tyler will take you through what may be the most detailed and in-depth teaching on intraday breakout strategies you will ever receive.

Then, so that you can be confident in your ability to apply these breakout strategies successfully, Chris Tyler will train you by working with you through 35 highly realistic bar-by-bar simulations of real-world breakout trades.

Best of all, this advanced knowledge is presented in a manner that makes it easy for you to learn and apply all of the strategies that Chris Tyler teaches!

This is the most in-depth training module to-date published by TradingMarkets. In it, Chris will teach you the complete logic and rules for a total of seven complete trading methodologies. And he will thoroughly train you how to properly apply each methodology through numerous simulations. You will be receiving the equivalent of 7 modules in one.

Here are breakout strategies that you will learn from Chris Tyler:

The Two-Minute Breakout Method

The Two-Minute Breakout Method enables you to enter powerful thrusts above the previous day’s and below the previous day’s low. Chris will teach you the rules you must follow in order trade the breakouts that have the greatest follow-through potential.

Once you have mastered the Two-Minute Breakout Method, you will know:

- How to create nightly lists of strongly trending stocks that have a high probability of potentially breaking above or below the previous day’s trading range. Chris will show you the best technical tools and resources for creating lists of the best long and short candidates. Then he will teach you how to use them so that each morning before the open, you will be ready with stocks to trade, whichever direction the overall market decides to move.

- How to enter what are often the most powerful intraday moves of the day. By trading stocks that meet Chris’ criteria and entering in the manner he teaches, you will be able to enter strong moves that are fueled by hedge funds and professional traders focusing on longer time frames who will scale in large positions at these levels.

- The optimum times of the day to trade 2-Minute Breakouts. Breakouts above or below the previous day’s range can occur any time during they day, but Chris will teach you about the 90 minute window of time during which you can find the breakouts that move the fastest and longest.

- The breakout bar pattern and technical factors that provide you with the best entries. As you proceed bar-by-bar through Chris’ detailed trading simulations, you will learn to quickly to recognize opportunities as they happen and enter trades when the 2-Minute Breakout is triggered.

The Flush’em Out Breakout Method

The Flush’em Out Breakout Method enables you to enter the real breakout that occurs after a succession of fake-out attempts. Chris will teach you how to trade the one breakout that is forceful enough to blow right past the resistance level. Note: this is a new and improved method based on the well-known Triple-Top and Triple Bottom pattern.

Copyright © 2002 Quote LLC. All rights reserved. QChartsô is a trademark of Quote LLC, a Lycos Network Company.

All other trademarks set forth herein are owned by their respective owners. The information set forth in this screen shot is historical data only, and not current information.

Once you have mastered the Flush’em Out Breakout Method, you will know:

- How to only trade stocks with the strongest directional bias. Once you have learned the tools and the parameters that Chris teaches you, you will be able to focus on stocks in which the direction of breakouts that occur is more predictable than normal.

- How to identify the real breakout after a series of failed attempts. How many times have you seen a stock that looks ripe for a powerful breakout? But each time it probes the highs (or lows for shorts) it fails. Chris will teach you how to watch from the sidelines until it is time to trade the breakout that is forceful enough to blow right past the resistance level.

- How to use a well-defined, easy to recognize pattern for clear, unambiguous entries. The Triple-Bypass pattern that Chris teaches you is easy to recognize and you will be able to apply rules for entries that are precise and well defined.

The Intraday Cup With Handle Breakout Method

Here’s how the Intraday Cup With Handle Breakout plays out:

You’re watching a powerfully trending stock surge higher. Suddenly, a powerful sell-off ensues. The uptrend is presumed dead or endangered as the price action plods along at the lows of a trading range. But the stock slowly creeps back up to its highs. You enter as late-comers to the old trend bail. The stock explodes and new money pours in. The uptrend comes back stronger than ever.

Once you have mastered the Intraday Cup With Handle Method, you will know:

- The characteristics of stocks that will most likely be the breeding ground for intraday cup with handles. Chris will teach you the filtering methods which allow you to key in on stocks that are most likely to be the breeding ground for intraday cup with handles.

- How to recognize a potential cup with handle continuation pattern on 5-minutes bars early…as it is forming. Cup with handle patterns are easy to recognize after the fact. But you are only able to take advantage of the powerful moves that they often trigger when you can recognize them well in advance, before the breakout occurs. Chris will not only walk you through the characteristics of developing cup with handles, but through his bar-by-bar simulations, he will train you on how to spot them before they are noticed by the general public.

- How to enter the breakout, just after the weak hands have bailed out of the stock. A good cup with handle will often send a message to traders that is frequently interpreted as technique weakness. Chris will show you how the pattern tips its hand and tells you that it is potentially about to break out. This will enable you to be ready to take action the moment the breakout begins.

The Trading Range Breakout Method

Through the Trading Range Breakout Method, you can enter a stock as it thrusts its way out of a long trading range past its “final resistance level.” The new trend you enter will then potentially be a nice, long run. Why? Because once you’re cruising into new high territory, there is no significant resistance for the stock to have to fight its way through!

Once you have mastered the Trading Range Breakout Method, you will know:

- How to enter at the beginning of trends that have potential for the longest duration moves. Chris will teach you the technical characteristics of trading range breakouts that can trigger new trends lasting through the entire trading session.. Chris will not only show you what these characteristics are, but he will also drill on how to quickly and easily recognize them so that you can act quickly enough to capture the entry.

- How to identify the overall market environment and individual stocks in which these opportunities are most likely to occur. Intraday Trading Ranges that meet Chris’ criteria do not happen every day. But on days in which you have a market and list of stocks that follow Chris’ checklist, you will be able to participate in these exceptional opportunities to trade long-duration moves.

- The price and volume setup that gives you the green flag to enter a breakout. Breakouts from intraday trading ranges can move quickly. Chris will teach you the price and volume action that clearly distinguishes it from a mediocre breakout and enables you to enter a trade and not have to chase after it.

The Intraday Pattern Breakout Method

With the Intraday Pattern Breakout Method, you can enter multiple breakouts within a high momentum intraday trend. This method can be used to pick off additional entries once you’ve entered initial breakouts trigged by the other strategies that Chris teaches you in this module.

Once you have mastered the Intraday Pattern Method, you will know:

- * How to find the strongly trending stocks with the most powerful momentum. Chris will teach you the tight criteria that is needed to generate lists of uptrending and downtrending stocks give you a greater than average probability producing long intraday trends.

- How to detect the formation of trends in which multiple patterns may be formed as the trend moves higher (or lower). Chris will show you how, if market conditions are conducive to take advantage of a sequence of entries as they occur.

- How to enter each pattern, control risk, exit, and then prepare for entry into the next one. Chris will teach you the skill-set you need in order to take advantage of a series of sharp one-way surges that emerge from flag or pennant formations.

Intraday ADX Donchian Breakout Method

With this enhanced approach of using Donchian Channels, the Intraday ADX Donchian Breakout Method, you will learn a mechanical way to enter a strong trend. At times this may allow multiple entries within the same trading session.

Once you have mastered the the Intraday ADX Donchian Breakout Method, you will know:

- The best parameter settings of the Donchian Channel indicator for use in trading intraday breakouts. Using a setting variation for Donchian Channels that has not previously been published, Chris will show you a new way to use this indicator to identify intraday breakouts while minimizing whipsaws.

- How to find stocks out of many thousands that are the best Donchian breakout candidates, both for longs and shorts. This indicator can only be used effectively on certain stocks that meet strict trend and Relative Strength criteria. And Chris will show you how to find these stocks each night.

- How use Donchian Channel breakouts to find trade entries for both longs and shorts. Chris will teach you what to look for in price action so that you will be able take full advantage of mechanical entries triggered by this indicator.

15-Minute ADX Breakout Method

By using the 15-Minute ADX Breakout Method, you will potentially be able to enter intraday breakouts minutes after the open in one stock, over and over again on several consecutive days.

Once you have mastered the 15-Minute ADX Breakout Method, you will know:

- A clear and precise way to quantitatively determine that a stock has sufficiently massive momentum in the daily time frame to move higher intraday, possibly for several consecutive days. Chris will show you how to use big picture trend analysis, to maximize the odds that you can enter a stock shortly after the open and exit after the stock has moved higher.

- How to “test” and confirm that a stock has a high probability of moving higher from the open. Chris will show you a method of determining, within the first 15 minutes of trading, whether the momentum within the daily time frame will likely dominate and influence intraday price movement.

- How to enter into momentum early once price action breaks out. Chris will teach you the entry that gives you the best opportunity to trade an intraday runaway move that commences early in the trading session.

Once You’re Done Learning The Strategies…

It’s Time To Properly Apply Them!

After Chris has taught you these powerful intraday breakout strategies, he will train you to apply them through a series of detailed bar-by-bar simulations. Using real market action, Chris will train you on the following:

* How to find the best intraday breakouts.

* How to recognize the right moment to enter them.

* How to set your initial stop to control your risk.

* How to move trailing stops to lock in profits as the position moves in your favor.

* How to scale out in order to let runaway moves play out longer in order to maximize your gains.

* and much, much more!

Chris’ module is only place in the world where you can receive this kind of “reality training” on trading breakouts.

Chris Tyler’s breakout strategies offer you a way of entering ahead of rapid moves in any time frame–without the guesswork. Plus, through his simulations, he will train you over and over again through 35 simulations on how to successfully execute trades. Try one of Chris’ simulations for yourself. Click on the green button below and Chris will walk you through an excerpt of a triangle trade.

Chris Tyler’s “The Most Effective Professional Breakout Strategies For Daytraders”

A “Chris Tyler Trading Series” Interactive Training Module Contents

There are four parts to this course. Here they are in the sequence in which you should tackle them:

Part I: How To Filter The Best Candidates

Relative Strength

Part II: Pattern Setups

Intraday Flags

Pennants

Trading Ranges

Intraday Cup And Handles

Donchian Channels

Flush ‘Em Out Breakouts

Two-Minute Breakouts

Part III: Stop Placement Strategies

Initial Stop Placement

Trailing Stop Strategies

Part VIII: Real-World Trading Simulations

Simulation Vehicle

Simulation One S&P 500 March E-mini futures [ESH3] Simulation Two eBay [EBAY] Simulation Three Nabors Industries [NBR] Simulation Four Igen [IGEN] Simulation Five Garmin [GRMN] Simulation Six Panera Bread [PNRA] Simulation Seven Anadarko Petroleum [APC] Simulation Eight SLM Corp. [SLM] Simulation Nine Silicon Laboratories [SLAB] Simulation Ten Centex [CTX] Simulation Eleven Omnicom [OMC] Simulation Twelve Ensco International [ESV] Simulation Thirteen Eli Lilly [LLY] Simulation Fourteen Nasdaq 100 March E-mini futures [NQH3] Simulation Fifteen Ross Stores [ROST] Simulation Sixteen Paychex [PAYX] Simulation Seventeen Burlington Resources [BR] Simulation Eighteen Kohl’s [KSS] Simulation Nineteen Zimmer Holdings [ZMH] Simulation Twenty Cognizant Tech Solutions [CTSH] Simulation Twenty-One Silicon Laboratories [SLAB] Simulation Twenty-Two American International Group [AIG] Simulation Twenty-Three eBay [EBAY] Simulation Twenty-Four S&P 500 March E-mini futures [ESH3] Simulation Twenty-Five Neurocrine Biosciences [NBIX] Simulation Twenty-Six QLogic [QLGC] Simulation Twenty-Seven Nabors Industries [NBR] Simulation Twenty-Eight Cognizant Tech Solutions [CTSH] Simulation Twenty-Nine Paychex [PAYX] Simulation Thirty Apache Corp. [APA] Simulation Thirty-One Patterson Energy [PTEN] Simulation Thirty-Two P.F. Chang’s China Bistro [PFCB] Part I

Simulation Thirty-Three P.F. Chang’s China Bistro [PFCB] Part II

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.