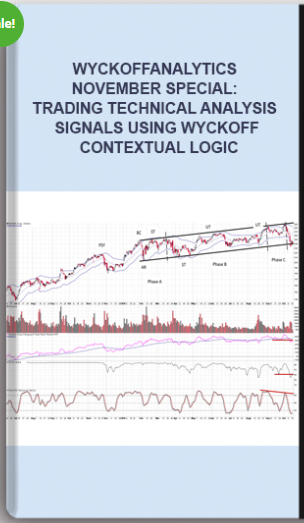

Wyckoffanalytics – November Special: Trading Technical Analysis Signals using Wyckoff Contextual Logic

Original price was: $199.00.$25.00Current price is: $25.00.

Sale Page :wyckoffanalytics

- Description

Description

Wyckoffanalytics – November Special:Trading Technical Analysis Signals using Wyckoff Contextual Logic

Checkout more: Wyckoffanalytics

Sale Page : wyckoffanalytics

This product is available

You can refer to the screenshots here :

Please contact us to get free sample

Price. Volume. Time. Sentiment. Recognizing and correctly interpreting different patterns of these variables – representing the flow of supply and demand – are at the heart of the Wyckoff Method.

Some experienced Wyckoffians trade successfully using these factors alone.

Many others use Technical Analysis (TA) tools to help decide when to enter and exit trades. Most traders know that some indicators work better in consolidations (e.g., oscillators), while others work better when a trend is underway (e.g., moving averages).

The Wyckoff Method’s framework for understanding the ever-changing market structure can help traders drill down to a deeper level to deploy different TA tools in the most appropriate environments.

In this month’s three-part webinar series – Trading Technical Analysis Signals using Wyckoff Contextual Logic – Roman Bogomazov will demonstrate how this approach can help traders decide which TA tools to use during different Wyckoff Phases and events in both trading ranges and trending environments.

During these sessions, Roman will share his extensive experience applying Wyckoffian contextual logic to indicators commonly used in conventional TA.

As he walks you through Selling and Buying Climaxes, Secondary Tests, Springs, Upthrusts and other Wyckoff events, he will describe how he has used:

-

Linear regression channels to help define the market environment – both trending and non-trending

-

Price and momentum indicators – Rate of Change (ROC), MACD, RSI and Stochastics

-

Trending tools – including moving averages, Bollinger Bands and Keltner Channels

-

Volatility tools – Average True Range (as well as Bollinger Bands and Keltner Channels)

-

Volume tools – up and down volume, on balance volume (OBV), horizontal volume, and Money Flow Index

-

Relative Rotation Graphs – a great top-down tool to help identify sector rotation

No one would dream of using all these indicators on the same chart.

However, after Roman’s presentations, you’ll be able to choose which of these would best suit your trading style and timeframe. And more importantly, you’ll be able to recognize different price environments appropriate for specific TA tools.

This will be a very content-rich series geared primarily towards traders familiar with the basics of the Wyckoff Method and multiple TA indicators. Please join us!

As usual, all sessions will be recorded and posted on a password-protected page for one full year, in case you can’t be online during one or more sessions. In addition, all participants will receive a pdf file of the slides used in the presentations.

Get Wyckoffanalytics – November Special: Trading Technical Analysis Signals using Wyckoff Contextual Logic on bestoftrader.com

Wyckoffanalytics, November Special: Trading Technical Analysis Signals using Wyckoff Contextual Logic, Download November Special: Trading Technical Analysis Signals using Wyckoff Contextual Logic, Free November Special: Trading Technical Analysis Signals using Wyckoff Contextual Logic, November Special: Trading Technical Analysis Signals using Wyckoff Contextual Logic Torrent, November Special: Trading Technical Analysis Signals using Wyckoff Contextual Logic Review, November Special: Trading Technical Analysis Signals using Wyckoff Contextual Logic Groupbuy.