Vladimir Ribakov – The Secret of the Double Doji Forex Trading Strategy

$37.00

Product Include:

File size:

- Description

Description

Vladimir Ribakov – The Secret of the Double Doji Forex Trading Strategy

**More information:

Get Vladimir Ribakov – The Secret of the Double Doji Forex Trading Strategy at bestoftrader.com

Description

This is a very simple strategy, yet one of the most reliable setup I’ve ever seen (and oh boy have I seen a lot of strategies in my Forex career…).

My name is Vladimir and I’ve been following this strategy and implementing it successfully for the past 4 years. I believe it’s about time I’ll share its simplicity and power with the Forex traders’ community. I’m sure a lot of people out there are eager to arrive to the place I’m in now.

So, where did this strategy come from?

I’m sure you’ve heard of Japanese Candlestick charts. The Candlestick theory is amazing, but unfortunately few traders give it top priority as it deserves.

The shape of the candle can tell us all. Every candle tells its part of the complete story. We just need to learn how to put together this puzzle.

The „Doji” pattern is one of the most incredible patterns among the Japanese candlesticks. For some reason it is not referred to very often. Maybe that explains why it is extensively used by pros…

The Doji hints us that the market is in a state of balance of powers: the buyers’ strength has run our, but so is the sellers’. So this is a state of temporary calmness, just before a major move.

This is where I come in.

4 years ago I realized the potential of candlestick analysis, and had a „New Year’s resolution” to master it. When I say master it I mean really comprehensively study it. Be a real „candlesticks archaeologist”, no stone left un-turned.

As the studying progressed, I realized I have a something very valuable in my hands. Its value can be measured with gold, and lots of ounces of it!

Why is it so valuable? Well, it’s a simple strategy, and I use it to make my living and take care of my family.

But… there’s another reason: four of my best friends are using it the same way as I do. There’s nothing more satisfying than knowing you’ve fulfilled your dreams and helped your friends fulfill theirs. So this goes really well with the „Strategies for $9.99” project.

Let’s get down to business and learn how to use the „Double Doji” strategy.

First, let’s see what a Doji is:

The Doji may appear in a variety of shapes, but the meaning of all of them is the same.

Here are the most typical examples of Doji candlesticks:

The meaning is that the opening and closing price of the candle are the same. Remember that each candle represents a certain amount of time. For example if you’re looking at a „1 hour” (H1) chart, each candle represents one hour of market activity.

Thus, the hour started with a certain price. The buyers fought the sellers, they each pounded each other, and in the end the price stayed the same.

In fact, imagine an arm wrestling fight when two world champions meet. The fight commences, each pulls to his own side… they invest a lot of force, sweat, their muscles tremble… but no winner yet… until the moment when one of them decides to end it.

This is similar to what happens in the market and portrayed by the Doji pattern. The Doji represents an arm wrestling fight between buyers and sellers, until one of the sides puts down enough force to win.

Now imagine what happens when you see not one, but two Dojis!

This is a world war between buyers and sellers. After such a war, you are most likely to have a knock-out winner. In other words, after 2 Dojis in a row there is a high probability of a strong move. A move which I’d certainly would like to take a part in.

That is why the first condition for this strategy is to identify 2 Dojis one after the other. It is preferable that the two Dojis will appear after a clear strong trend, for example an up trend or a down trend.

Note: a candle with a body of just a few pips, 2-4 pips, is considered a Doji.

Let’s look at some examples…

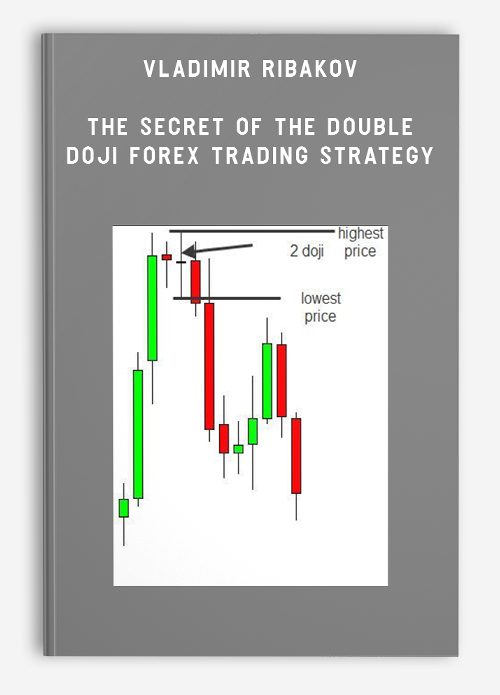

Example 1: two Dojis in a row (the two rightmost candles):

Example 2: two Dojis after an up move:

After you’ve spotted the two Dojis comes the second condition:

You should mark the borders of the two Dojis. As you can see in the screen shot below, I’ve marked the upper and lower borders of those two Dojis:

…and here’s another example of marking, plus what happens next…

…once the border is crossed, a move is underway so I would like to get in the action.

The third condition of this strategy:

Place two pending orders. One in case the market breaks the upper border of the Dojis (1 pip above it is enough) and one in case the market breaks the lower border (1 pip below).

Now you need to arrange for the Stop Loss of the trade:

For a Buy (Long) trade, place the Stop Loss 1 pip below the Doji’s lower border.

For a Sell (Short) trade, place the Stop Loss 1 pip above the Doji’s upper border.

Now for the more cheerful part of determining the profit target, or the amount of profit you expect to extract from this trade:

I’d like to present to you 3 different methods of managing this trade. All three have been thoroughly tested and proven to provide impressive and consistent results.

So, why three methods? Because each one of us has their own personal strengths and weaknesses. Some find it difficult to hold on to a trade for a long period of time. Others love to take profits quickly even if its not that much. Yet others have a lot of patience and can hold on to a trade without fears.

Trade management method 1:

Take Profit is equal to the Stop Loss.

For example: my Take Profit is 50 pips and my Stop Loss is also 50 pips.

The percentage of winning trades is around 70% so if we keep trading consistently the gains can accumulate.

Trade management method 2:

This one is my personal favorite. You open 2 identical trades.

The first has a Stop Loss equal to the Take Profit. The second has a profit target which is double the Stop Loss. For example: Stop Loss is 50 pips and Take Profit is 100 pips.

It’s a good idea to move the Stop Loss to the opening price of the trade („Break Even”) once the first trade exited in profit.

Here’s another trade example:

As you might noticed, my first profit target was identical to the Stop Loss, while the second profit target should double the Stop Loss.

Also note that the double Doji pattern appeared after an up move which consisted of 3 green candles in a row. The reliability of such a trade is very high!

Trade management method 3:

Open one trade with a profit target which is half the Stop Loss. Let’s say I determined the Stop Loss to be 50 pips, thus the first target would be 25 pips. This is where I’ll close 80% of the trade.

For example, if I opened 1.0 lot, I’ll close 0.8 lots once the 25 pips target is reached: 1 x 0.8 = 0.8.

The second profit target, for the remaining 0.2 lots, would be two times the Stop Loss. Thus, continuing the previous example, my Take Profit would be 100 pips.

Before I leave you to enjoy this strategy a few quick tips:

- Work best on the 1-hour, 4-hours and daily charts.

- The best currency pairs are the ones that involve the USD, and also all the Yen crosses (EUR/JPY, GBP/JPY, AUD/JPY etc.).

For your convenience here’s a summary of the rules:

- Spot 2 Dojis in a row. It’s better when they appear after a clear up or down trend (minimum of 3 green or red candles in a row).

- Mark the upper and lower border of these Dojis’ highs and lows.

- Wait for one of the borders to break. No need to actually wait, just insert 2 pending orders.

- When one of the orders executed, I’ll cancel the other one. Choose one of the three trade management methods and follow it to the letter.

- Collect profits.

I’m proud to have the opportunity to present to you such a successful strategy, and to help you reach your financial goals.

Good luck with this week’s trading,

To your success,

Vladimir Ribakov

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.