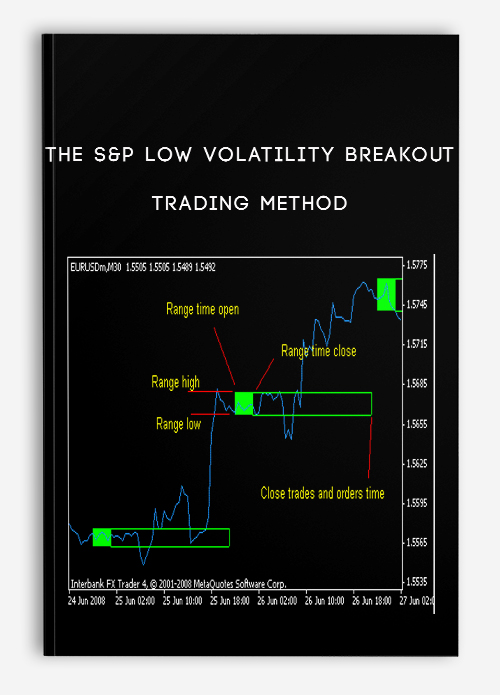

The S&P Low Volatility Breakout Trading Method

$217.00

Cost For You: $217

- Description

Description

The S&P Low Volatility Breakout Trading Method

Archive : The S&P Low Volatility Breakout Trading Method

Trade the Power of S&P Breakouts

Combine the Safety of Blue Chips with Gains of Breakouts in a Single Strategy

One of the first trading scenarios that many traders learn is the concept of a “breakout”. This is possibly because a “breakout” is thought to be “easy to spot”, making breakout strategies very popular.

However, lack of proper knowledge, coupled with emotion-based decisions can lead to incorrect techniques that may prevent you from trading breakouts successfully.

Connors Research has recently applied a thorough quantified approach to breakout strategies, resulting in the new S&P Low Volatility Breakout Trading Strategy. Backed by data from over 11 ½ years of simulated historical results, this strategy may improve your success with breakouts by giving you several specific ways to:

- Identify True Breakouts.

Many traders rely on visual interpretation of charts and graphs. We give you quantified filters and entry rules — eliminating guesswork and personal interpolation. - Maximize Your Gains.

Precise exit rules can help prevent you from being fooled by “temporary corrections” and help you learn how to hold the position long enough to realize the full potential of each trade. (Read on to see an example…) - Focus on Safety

– The strategy trades blue chip stocks with low volatility

– The positions are all long, taken with the trend

– Medium-term holds (4 months on average)

– Share turnover is low

– Moves to cash in bear markets The S&P Low Volatility Breakout Trading Strategy is designed to meet the needs of IRA accounts, Investment Advisors, and traders seeking to outperform the market with significant controls for risk — built-in.

Get The S&P Low Volatility Breakout Trading Method on bestoftrader.com

The S&P Low Volatility Breakout Trading Strategy

– – Back-tested Results

This is the first time Connors Research has ever offered a quantified stock trading breakout method. Over the years, one of our most popularly used strategies is the S&P Selective Strategy. As strong as that strategy is, we believe the quantified research on this strategy is even stronger.

Here are the simulated historical returns for this strategy:

(mouseover to enlarge)

Here is a sample signal on XEL. The Entry Signal from the strategy is March 12, 2012 at $26.14. The strategy held the position through two “temporary corrections” to post its Exit Signal on July 30, 2012 at $29.18 — a gain of 11.56%.

Here is strategy signal on MasterCard (MA). The Entry Signal from the strategy is Feb. 6, 2012 at $390.54, and its Exit Signal came on Sept. 28, 2012 at $451.48 — a gain of 60.94 points.

Below is another simulated trade, this one on Pfizer (PFE). The Entry Signal from the strategy is June 25, 2012 at $22.07, and the Exit Signal is on Sept. 28, 2 012 at $24.85 — a gain of 12.46%.

This Strategy is Available Only Until Nov. 14th

The S&P Low Volatility Breakout Trading Strategy is being offered to a limited number of traders for a short period of time.You will not be competing with thousands of other traders for fills.

- The S&P Low Volatility Breakout Trading Strategy is available for purchase — on a pre-order basis — only until November 14, 2012.

- A One-time Distribution of the Strategy:

The S&P Low Volatility Breakout Trading Strategy will be taught personally by Larry Connors at an online presentation on November 14, 2012.You will also receive a recording of the teaching presentation, along with the written documentation for the strategy — all on Nov.14th minutes after the meeting concludes via a download link. - After the Nov.14th teaching presentation, this strategy will be removed from the market for at least 12 months.

Benefits of the S&P Low Volatility Breakout Trading Strategy

- Trades Only High-Quality Blue Chip Stocks

- Low-Volatility / High-Gain Profile

- Limited Distribution to Reduce Competition from Other Traders

- This Strategy is Designed to Minimize Risk.

We believe this particular combination of features will make the S&P Low Volatility Breakout Trading Strategy one of our more popular strategies for traders seeking a combination of solid gains with low risk.

P R E – O R D E R H E R E:

The S&P Low Volatility Breakout Trading Strategy

******One Business Day Course Delivery: For security purposes, course files will be sent to you within one business day via email after your payment is processed.******

Price: $2,000

If you have any questions, please call us directly at

888-484-8220 ext. 3, 9am-5pm ET, M-F,

(or 973-494-7311 ext 3, outside the U.S.)

S&P Low Volatility Breakout Trading StrategyPrice: $1,995

The S&P Low Volatility Breakout Trading Strategy can help you learn to trade breakouts with precision . . .

About the Strategy Authors

Larry Connors

Chairman & Founder, Connors Research. Larry Connors has over 30 years in the financial markets industry. His opinions have been featured at the WSJ, Bloomberg, Dow Jones, & many others. Mr. Connors has been an active trader since 1981. His strategies and research are used by thousands of traders throughout the world.

Cesar Alvarez

Director of Research for Connors Research LLC. Previously, Mr. Alvarez was a senior developer of Microsoft Excel. For the past 12 years, Mr. Alvarez has been a professional market researcher with Connors Research. Mr. Alvarez is at the forefront of stock market research, with a number of his trading systems now used by professional money managers & fund managers.

About Connors Research

For over 12 years, Connors Research has provided the highest-quality, data-driven research on trading for individual investors, hedge funds, proprietary trading firms, and bank trading desks around the world.The strategies published by Connors Research are:

- Completely Original & Unique to Connors Research

You will not find these strategies published anywhere else. - Consistent with Strategies Used by Billion-Dollar Hedge Funds

Institutional money managers make decisions based on sophisticated, computer-run analyses of massive amounts of trading data. - Historically Validated Over Many Years and All Types of Markets

We quantify precise patterns to improve your trading decisions. Our proprietary database spans over two decades, with more than 12 million quantified trades. - Tens of Thousands of Traders Have Relied on Our Research Over The Years

From best-selling books, like “How Markets Really Work”, to our PowerRatings subscription service, Connors Research continues to give active traders tools to achieve professional-level results.

Get The S&P Low Volatility Breakout Trading Method on bestoftrader.com

The S&P Low Volatility Breakout Trading Method Download, The S&P Low Volatility Breakout Trading Method Download, The S&P Low Volatility Breakout Trading Method Groupbuy, The S&P Low Volatility Breakout Trading Method Free, The S&P Low Volatility Breakout Trading Method Torrent, The S&P Low Volatility Breakout Trading Method Course Download, The S&P Low Volatility Breakout Trading Method Review, The S&P Low Volatility Breakout Trading Method Review